Homeownership often presents challenges, particularly for those with financial constraints. However, Michigan residents have a lifeline in programs like the Michigan State Housing Development Authority (MSHDA) loans and down payment assistance (DPA), which provide vital support to turn individuals into home owners.

What is an MSHDA Loan?

MSHDA is a state agency committed to promoting affordable housing opportunities for residents. One of its flagship initiatives is assisting individuals who lack the financial means to make a substantial down payment on a home purchase. This can include first-time homebuyers, potentially repeat homebuyers, and current homeowners in targeted areas. The best resource for finding out what programs are available is to call an experienced lender who can find out if you qualify.

It’s important to understand that the term “MSHDA loan” is somewhat misleading. In reality, borrowers are not obtaining a separate loan from MSHDA; instead, they are receiving financial support in the form of down payment assistance, which is added to their first mortgage. Essentially, MSHDA acts as a financial partner, offering up to 10 thousand dollars in select areas to alleviate the upfront costs of purchasing a home.

MSHDA loans can be used with various loan programs, including FHA, conventional, VA, and USDA. This flexibility allows borrowers to access MSHDA’s down payment assistance alongside the specific benefits offered by these loan options.

Advantages of MSHDA Loans

MSHDA loans assist borrowers in bridging the financial gap typically required in a mortgage. In a standard purchase transaction, borrowers must provide funds for the down payment, closing costs, and prepaids to establish escrows for taxes and insurance. MSHDA home loans aim to close this gap, enabling many borrowers to purchase a home with as little as 1% of their purchase price.

MSHDA loans offer several advantages that make homeownership more accessible to Michigan residents:

- MSHDA offers down payment assistance programs that provide financial assistance to cover down payments and closing costs, reducing the upfront expenses associated with buying a home.

- Buyers can leverage MSHDA’s resources to afford homes in different Michigan communities or school districts.

- MSHDA’s statewide program ensures accessibility across Michigan.

- As the state’s Housing Finance Agency, MSHDA provides exclusive benefits like discounted mortgage insurance.

- More stability in interest rate fluctuations

- MSHDA offers below-market interest rates, further reducing mortgage payments and increasing purchasing power.

- This comprehensive approach enhances affordability and competitiveness in Michigan’s housing market.

MSHDA Loan Programs

MI Home Loan

The MI Home Loan caters to both first-time homebuyers statewide and repeat buyers in specific areas. Under the MI Home Loan, all adults residing in the home must apply for and qualify for the loan, with some exceptions for full-time students or disabled household members.

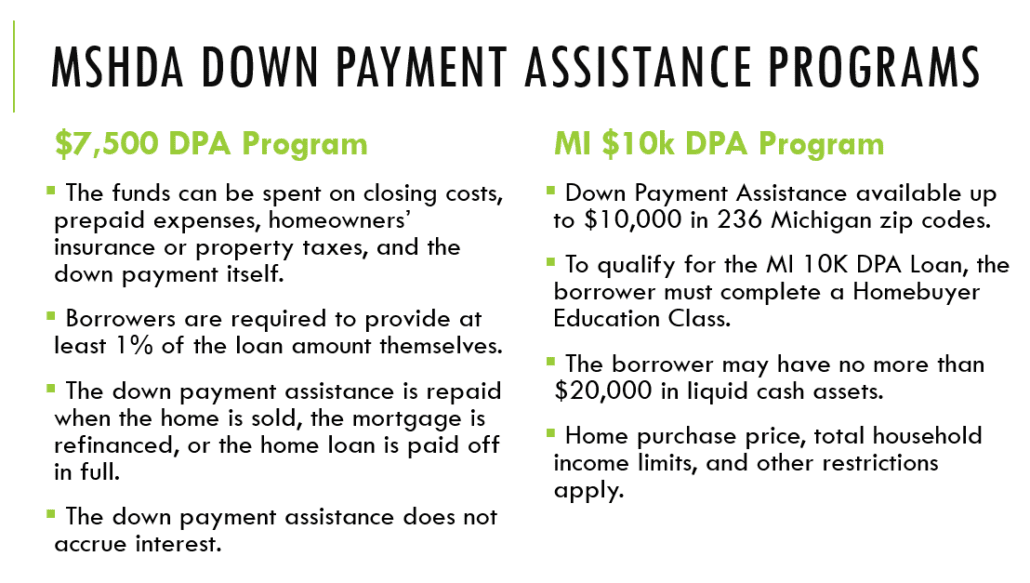

Down Payment Assistance (DPA) Programs

Down payment assistance (DPA) programs play a crucial role in helping homebuyers overcome financial hurdles. Think of a DPA program as a tool to help you, as a buyer, make a more competitive offer on a home. With favorable terms, including a 0% interest rate and no monthly payments, it is a valuable resource in the home buying process. However, it is important to keep in mind that the DPA is indeed a loan and will need to be repaid in the future.

For homebuyers who qualify, MSHDA offers down payment assistance statewide. When utilizing MSHDA’s Down Payment Assistance (DPA), buyers must typically provide 1% of the purchase price upfront. For example, if the home is priced at $100,000, the borrower must bring in $1,000. MSHDA then supplements this with up to $10,000 in assistance, helping buyers bridge the financial gap required for their home purchase.

Repayment of MSHDA Loans

The down payment assistance provided by MSHDA is not forgivable, meaning it must be repaid at some point. While borrowers don’t have to make monthly payments or incur interest on this assistance, they are required to pay back the borrowed funds.

However, if you remain in your home without refinancing or selling, there’s no immediate obligation to repay. Essentially, it’s a deferred payment arrangement where you pay back the assistance when specific events occur. So, if you decide to refinance your home in the future or sell it and it has appreciated in value, you’ll need to satisfy the loan against the property to repay the assistance received.

Steps to Apply for an MSHDA Loan

Applying for an MSHDA loan follows a structured process:

- Find an approved MSHDA lender: Borrowers should identify lenders approved by MSHDA, like Mortgage 1, to originate loans under its programs.

- Completing the MSHDA loan application: Applicants must complete the necessary paperwork and provide supporting documentation to the lender.

- Work with a knowledgeable real estate agent: Partnering with an experienced real estate agent can streamline the homebuying process and provide valuable guidance throughout the transaction.

Michigan Mortgage is a Top MSHDA Lender

MSHDA loans and Down Payment Assistance programs offer valuable support to Michigan residents seeking to achieve the dream of homeownership. Michigan Mortgage has been a top MSHDA lender for the past decade, helping numerous homeowners with affordable financing. Give us a call if you want to explore your options!

The U.S. Department of the Treasury notified MSHDA on April 14, 2021, that it will allocate $242,812,277 to the State of Michigan. This number was based on unemployed individuals and the number of mortgagors with delinquent mortgage payments.”

The U.S. Department of the Treasury notified MSHDA on April 14, 2021, that it will allocate $242,812,277 to the State of Michigan. This number was based on unemployed individuals and the number of mortgagors with delinquent mortgage payments.”

What Is MSHDA?

What Is MSHDA?

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

Take it right out of your paycheck and transfer a fixed amount into a special savings account. This is probably the most convenient and practical way to save. Take it right out of your paycheck. Make sure you set up an automatic direct deposit into a savings account that is earmarked for your down payment only. Commit to using this money for a down payment and no other purpose.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.