#MMGivesBack: Realtors Who Care

Realtors Who Care is the charitable arm of the West Michigan Lakeshore Association of Realtors. Their goal is to make our local community a better place to work and live.

Mission Statement: Realtors Who Care shall strive to support Realtors first, people focused local charities, individuals in need and the National Association of Realtors recommended disaster relief.

They often give $300 to support individuals and charities in need and $600 to Realtors in need and disaster relief efforts designated by the National Association of Realtors.

They often give $300 to support individuals and charities in need and $600 to Realtors in need and disaster relief efforts designated by the National Association of Realtors.

Loan Officer Hayley Woodworth is Co-Chair of the Realtors Who Care Committee and selected the non-profit organization as this month’s #MMGivesBack charity.

Why?

“Realtors give back so much to their clients and communities,” she said. “I think it is important that we support them when they are in need. We meet so many people through this industry, and when you meet someone going through a hardship, it’s such a great feeling to be able to help them.”

The group experienced a very successful 2018 full of giving but has even bigger dreams for the year ahead.

“The goal for 2019 is to raise as much money as possible so we can give more than we ever have back to the local community,” Woodworth said. “We are also striving to gain as much exposure as possible so Realtors, affiliates and the community become aware of our organization.”

“We want to get more people involved and encourage more requests and submissions for donations for people and places in need,” she said.

How can you get involved?

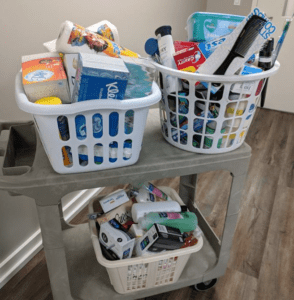

“In May, Realtors Who Care collects toiletries and personal items for local shelters and food baskets,” Woodworth said. The group takes the donated items and assembles baskets for those in need.

Items include: shampoo and conditioner, toothpaste, paper towel, feminine products, deodorant, tissues, and other household items used on a daily basis.

More information about Realtors Who Care, their mission and the May Basket charity initiative is available on their Facebook page.

Some know the dream is in reach while others question their ability to make the large purchase at every turn. Laura McCarthy was one of those people. She thought homeownership was something she may never achieve.

Some know the dream is in reach while others question their ability to make the large purchase at every turn. Laura McCarthy was one of those people. She thought homeownership was something she may never achieve.

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

It all started many, many years ago. In third grade, in fact. Long before Rob Garrison was a licensed Loan Officer, he spent his days on the playground with Brian Fredricks. A friendship was born and it has lasted for nearly half a century.

“I volunteered with Kids’ Food Basket in the past and fell in love with their mission to ensure children in our community do not go hungry,” she said. “They support numerous local schools and prepare thousands of sack suppers on a weekly basis.”

“I volunteered with Kids’ Food Basket in the past and fell in love with their mission to ensure children in our community do not go hungry,” she said. “They support numerous local schools and prepare thousands of sack suppers on a weekly basis.”

In 2006, Jessica Luepke took her Exercise Science degree from Hope College and time spent in corporate wellness and established Valeo in her apartment. The business has grown to what it is today with her passion for functional training and her passion for creating a space for people to feel welcomed and proud of themselves.

In 2006, Jessica Luepke took her Exercise Science degree from Hope College and time spent in corporate wellness and established Valeo in her apartment. The business has grown to what it is today with her passion for functional training and her passion for creating a space for people to feel welcomed and proud of themselves.

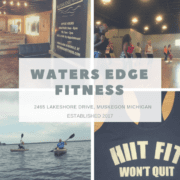

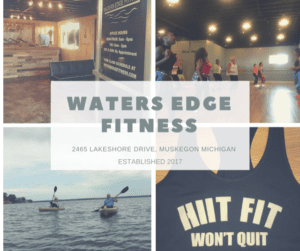

Believing that health and fitness are an integral part of living a happy, productive life, Waters Edge strives to offer the most diverse and accessible schedule of classes in Muskegon. From Yoga and Tai-Chi to Zumba and weight-training, the goal is to provide a fitness (and time) option for anyone looking to move and sweat in an atmosphere that is affirming and encouraging.

Believing that health and fitness are an integral part of living a happy, productive life, Waters Edge strives to offer the most diverse and accessible schedule of classes in Muskegon. From Yoga and Tai-Chi to Zumba and weight-training, the goal is to provide a fitness (and time) option for anyone looking to move and sweat in an atmosphere that is affirming and encouraging.

Until recently I had always thought my goals had to be monumentally planned out. I envisioned setting aside 90 days for each goal, spending days planning out each step, laying it out on the calendar, and executing every day for three months. And while that’s a completely valid, brilliant way to see progress in your life, I was getting hung up on how many 90-day goals I had. If I have 10 major areas of my work and life I want to improve on, it’d take me nearly three years to get through it all!

Until recently I had always thought my goals had to be monumentally planned out. I envisioned setting aside 90 days for each goal, spending days planning out each step, laying it out on the calendar, and executing every day for three months. And while that’s a completely valid, brilliant way to see progress in your life, I was getting hung up on how many 90-day goals I had. If I have 10 major areas of my work and life I want to improve on, it’d take me nearly three years to get through it all!

But have you ever thought that way about your time?

But have you ever thought that way about your time?

For instance, let me show you two possible stories about my morning:

For instance, let me show you two possible stories about my morning:

Nope. Most salons have literally hundreds upon hundreds of shades to choose from. Last night’s salon had not only 2 walls filled with bottles, but also every variation of pink, red or purple you could imagine. And the hot pink looks identical to the neon pink looks identical to the shocking pink.

Nope. Most salons have literally hundreds upon hundreds of shades to choose from. Last night’s salon had not only 2 walls filled with bottles, but also every variation of pink, red or purple you could imagine. And the hot pink looks identical to the neon pink looks identical to the shocking pink.