Buying a home might be the single biggest purchase you make in your life. You want it to go right. That is why the mortgage lender you choose is critical to making sure your homeownership dreams come true and the experience is hassle-free.

Whether you are a first-time buyer needing assistance through the lending process or you are an existing homeowner seeking to refinance or purchase a vacation home, it pays to go with a local lender as opposed to a big-name national bank or brand.

Here’s how a local mortgage lender can help guide you home.

1. Personalized Service

1. Personalized Service

A local mortgage lender gives you the chance to to work face-to-face with an expert, if need be. The growth of digital mortgages, like our Home Snap app, has eliminated the need for as much face-to-face meeting in the past, but as a home buyer it can be reassuring to know that your loan officer is right around the corner as opposed to across the country or overseas.

A local lender gets to know you. Your messages won’t sit in a voicemail box unanswered for weeks on end. With Michigan Mortgage, you’ll get a cell number for your loan officer and can call or text them at a moment’s notice to get your questions answered.

Local Loan Officers have an incentive to provide you with excellent service because they want you to be a source of referrals for future business. Our loan officers know that whether you have a great experience or a bad one, your friends and relatives are going to hear about it. Our loan officers live and work in your neighborhood. They want the best for you and the community. They have a vested interest in having each and every loan close as smoothly and efficiently as possible.

2. Local Expertise

Another advantage of local lenders is their familiarity with local market conditions. Local lenders know their local neighborhoods, so they know what’s going, what the trends are, and they use that knowledge when helping buyers obtain mortgages.

For example, a national lender with no roots in the local community may be reluctant to approve a mortgage for an atypical property, such as an original farmhouse on acreage that’s now covered by a subdivision. A local lender will know the history of the area and the changing demographics and economic trends and may be more comfortable underwriting such a loan.

Local lenders also have their finger on the pulse of the local or regional economy, and have a better sense of the lending risks in the area. What looks to a big lender like a dilapidated section of town might actually be an up-and-coming area where properties re increasing in value. Local lenders will know this.

Local lenders may also be more attractive to some home sellers and real estate agents who want an efficient and timely closing. Reputation matters. In situations where several offers are on the table, having a local, trusted lender could be the difference between closing or not closing.

3. Realtor Relationships

Local lenders invest a lot of time and effort building relationships with local Realtors. Realtors and lenders are the yin and yang of real estate. Michigan Mortgage Loan Officers are on a first-name basis with most of the real estate agents in their local areas.

Many local loan officers have extended hours, allowing borrowers and Realtors to contact them during the evenings and weekends. If you see a house you love on a weekend, chance are you can reach your loan officer and get an approval quickly.

Also, with everyone on your team – the Realtor, the lender, you– working in proximity, a closing can happen quickly and without hassle. The final stage of home buying is sometimes the most stressful. Having a unified team that is familiar and comfortable with each other can make the process quick and painless.

4. Varied and Specialized Products

Local lenders have a better understanding of property values and the local economy. When you work with Michigan Mortgage, you’re paired with a licensed loan officer and team of professionals who are experts in your region. Our loan officers help you choose the right type of loan for your circumstance and we keep you updated along the way. We have in-house tools and resources to expedite a loan, ensuring everything is taken care of in a timely manner.

Local lenders are where you’ll find the specialized loans the big lenders won’t bother with. Maybe you want an adjustable-rate mortgage with a 15-year lock? Or you want to buy a vacation property that lacks a furnace? Or you want to buy or refinance a home for less than $100,000, an amount too small to be of interest most lenders? Or you want a jumbo loan?

Local lenders are have more flexibility. Big banks need process large numbers of loan applications. To do that, they have rigid guidelines about who they will and won’t lend to. Big banks are more about volume than customer service.

At Michigan Mortgage, we have been Michigan’s leading MSHDA first-time buyer lender for 7 straight years. We are also a recognized USDA rural development leader.

5. Reliable, Responsive & Flexible

Local lenders are better at closing loans on a timely basis. If the closing of a loan has to be extended by a week, local lenders are more flexible than big banks who have corporate mandates to crank out the volume.

Local lenders, along with local real estate agents, have an incentive to provide you with excellent service because they want you to be a referral source for future business. They stake their reputation on each and every customer.

With a local lenders, you are much closer to the decision makers with the authority to approve your mortgage. You aren’t dealing with a corporate bureaucracy.

Local loan officers are more likely to get personally involved in qualifying you for a mortgage, as opposed to big banks. Often, it’s a matter of the getting to know you. Perhaps you are self-employed with irregular income. Or you have poor credit due to a financial crisis, but have good income and low debt.

Michigan Mortgage Loan Officers are better suited to be responsible and flexible for borrowers like these.

At Michigan Mortgage, you will never be just a name or number on a loan application. We manage every step of the mortgage process, from application to underwriting to closing, to make the process easy. We have been financing the American homeownership dream for nearly 25 years. We can do the same for you.

This blog post was written by experts at Mortgage 1 and originally appeared on www.mortgageone.com. Michigan Mortgage is a DBA of Mortgage 1.

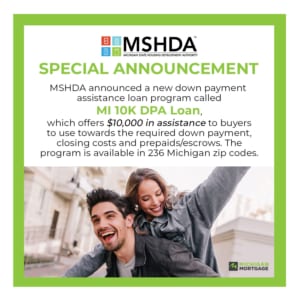

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.

For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.

For first-time buyers, the mortgage process raises a lot of questions. In part two of this series, we tackle some more of the most common questions we receive from customers.

Technically speaking, “A mortgage is a debt instrument secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.” (Investopedia.com)

Technically speaking, “A mortgage is a debt instrument secured by the collateral of specified real estate property, that the borrower is obliged to pay back with a predetermined set of payments.” (Investopedia.com)

Interest is what makes all forms of borrowing possible. Interest is the fee a lender charges for loaning money.

Interest is what makes all forms of borrowing possible. Interest is the fee a lender charges for loaning money.

Step 1: Check Your Credit Score

Step 1: Check Your Credit Score

1. Personalized Service

1. Personalized Service

What Is a Physician Mortgage Loan?

What Is a Physician Mortgage Loan?

What Are the Benefits of a USDA Loan?

What Are the Benefits of a USDA Loan?

Once the crisis passes, there will be even more buyers and sellers. Some mortgage forecasters are predicting a pent-up demand of buyers flooding the market.

Once the crisis passes, there will be even more buyers and sellers. Some mortgage forecasters are predicting a pent-up demand of buyers flooding the market.