A First-Time Buyer’s Guide

Next to having a child or getting married, buying a house might be the biggest event in most people’s lives. Purchasing a home is an exhilarating symbol of independence. It is the embodiment of the American Dream.

For first-time buyers, the home buying process can seem daunting. Thankfully, Michigan Mortgage is here to help. We assembled this 10-step home buying guide to help first-timers understand the home-buying process.

Step 1: Check Your Credit Score

Step 1: Check Your Credit Score- Step 2: Save for a Down Payment

- Step 3: Calculate What You Can Afford

- Step 4: Choose a Mortgage Lender

- Step 5: Get Preapproved

- Step 6: Find a Real Estate Agent

- Step 7: Find a House

- Step 8: Make an Offer

- Step 9: Get an Inspection

- Step 10: Closing

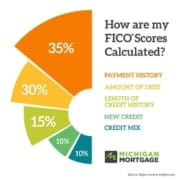

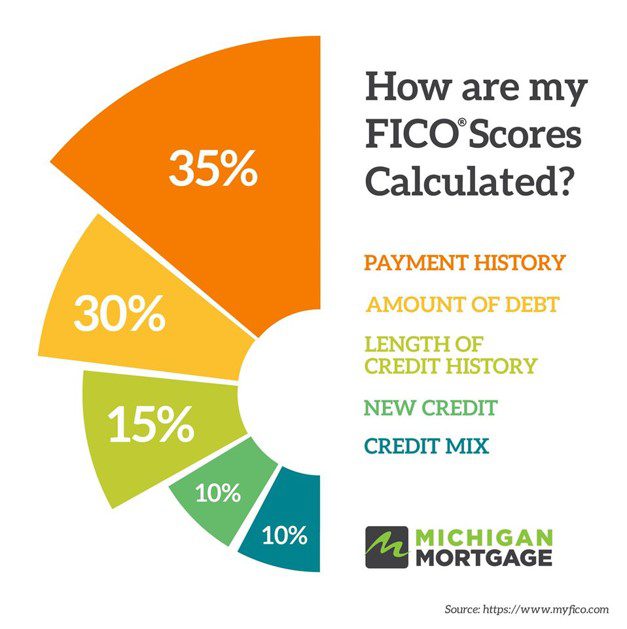

Step 1: Check Your Credit Score

Your credit score is critical to determining whether you will be approved for a mortgage, as well as the rate you will pay, so it is worth checking your credit score and taking steps to improve it. Buyers with higher credit scores usually get better interest rates. To obtain a conventional mortgage, you’ll need a credit score of 620 or higher. For FHA loans, the minimum credit score requirement is 580.

Step 2: Save for a Down Payment

When it comes to a down payment, the general rule of thumb is that the down payment on a mortgage should be 20 percent of the home’s price. Putting 20 percent down helps you avoid extra fees such as mortgage insurance.

If you can’t put 20 percent down, don’t worry. A mortgage down payment can be as low as 10 percent, 5 percent, or even 0 percent for certain types of mortgages, such as VA loans or USDA loans.

In addition to the down payment, you will need to save money for closing costs. These are fees related to the processing of your loan. You can expect closing costs to be 3 and 6 percent of the home purchase price.

Step 3: Calculate What You Can Afford

Your mortgage lender will ultimately tell you how much money you qualify for. But even before you speak with a mortgage lender, you can calculate how much house you can afford to make sure you don’t overextend yourself.

When calculating how much house you can afford, use the 28/36 percent rule, which says:

- Do not not spend more than 28 percent of your gross monthly income (your salary before taxes) on housing expenses

- Do not spend more than 36 percent of your gross monthly income on monthly debt payments (mortgage, car payments, subscription services, credit cards, etc.)

The calculations are as follows:

- Maximum Monthly Housing Expenses = (Gross Monthly Income X 28) / 100

- Maximum Total Monthly Debt Payments = (Gross Monthly Income X 36) / 100

Step 4: Choose a Mortgage Lender

Just as you choose your own real estate agent, you choose your own mortgage lender. Many buyers use lenders based upon the recommendations of their real estate agents, but you can choose whichever lender you want.

When comparing lenders, each one will provide you a Loan Estimate, which defines the loan terms, expected payments, and closing costs for your mortgage. You will be able to compare the estimates to see the differences between what each lender offers.

Step 5: Get Preapproved

Getting preapproved by a lender can be helpful when you are putting in offers on houses. When you are preapproved, sellers will have more confidence that your offer on their house will pass final approval.

Preapproval involves a lender pulling your credit information and assessing your financial situation. The lender will provide you with a letter that indicates the amount the lender is willing to lend you.

Step 6: Find a Real Estate Agent

Real estate agents take the stress out of the home buying experience. Your agent is your chief advocate, confidante and hand-holder in the process, so you want to find a good fit. Agents provide knowledge of the housing market and they have skills in the negotiation process. A real estate agent will represent you throughout the home buying process to ensure that you find the right home, ask the right questions and make the right offer. Agents have the power to negotiate on your behalf and serve as your buyer. Agents are only paid a commission if you close on a new home. The commission they receive is paid by the seller through the purchasing price of the house.

Step 7: Find a House

As you shop for houses, you’ll find that the more houses you see, the more they all start to blend together. So, try to be organized and make sure that you talk to your agent about your likes and dislikes about each one.

When visiting each listing, pay attention to the neighborhood that the home is in, as well as the home itself. Drive around the area. Consider what your commute will be like. Research the schools your kids would go to and figure out how long it would take them to get there. Find out where the closest grocery store and pharmacy is located. Make sure the area fits your style.

When touring each house, take photos and make notes. Make sure each home meets your needs. Think about the style of the home: Does it fit your lifestyle? Are there enough bedrooms? Enough bathrooms? A big enough garage and yard?

Step 8: Make an Offer

For most buyers, this is when the excitement peaks. Once you’ve found a home you want, your agent will work with you to write a purchase offer. The listing price is only a starting point. Your agent will understand the market and help guide you to make the best offer. Once you’ve submitted the offer, the seller will respond with a yes or no or a counteroffer. If your offer is accepted – congratulations, you are one your way to becoming a homeowner!

Step 9: Get an Inspection

If your offer is accepted, you have the right to have the home inspected. Your real estate agent can recommend a professional home inspector. The home inspection will identify areas where repairs or renovations are needed. If significant repairs are needed, you can request that the seller complete them before the closing. If the seller declines or you feel uncomfortable purchasing the house because of what the inspection found, you can most likely withdraw your offer.

Step 10: Closing

This is the big day. The closing is when you gather around a table with the seller and their agent, your agent, and representatives from the title company. You’ll read and sign a slew of papers that finalize your home purchase. It’s an exciting experience, especially for first-time buyers. Once the closing is done, you are now, officially, a proud homeowner!

At Michigan Mortgage, we specialize in helping first-time buyers navigate the mortgage process. We guide you along the way and work to get you the best rate and terms possible.

This blog post was written by experts at Mortgage 1 and originally appeared on www.mortgageone.com. Michigan Mortgage is a DBA of Mortgage 1.

1. Personalized Service

1. Personalized Service

What Is a Physician Mortgage Loan?

What Is a Physician Mortgage Loan?

What Are the Benefits of a USDA Loan?

What Are the Benefits of a USDA Loan?

Hadlee: Often we think of a distinction between our physical health and our emotions, mental clarity, moods, and thoughts. But in actuality, our physical and mental health are inextricably connected.

Hadlee: Often we think of a distinction between our physical health and our emotions, mental clarity, moods, and thoughts. But in actuality, our physical and mental health are inextricably connected.

Conventional Loan

Conventional Loan

Once the crisis passes, there will be even more buyers and sellers. Some mortgage forecasters are predicting a pent-up demand of buyers flooding the market.

Once the crisis passes, there will be even more buyers and sellers. Some mortgage forecasters are predicting a pent-up demand of buyers flooding the market.

It is important for you to analyze your spending habits. If you do not have a budget, you should start one now. This will help you understand you spending habits so that the lifestyle that is important to you will be maintainable as a homeowner.

It is important for you to analyze your spending habits. If you do not have a budget, you should start one now. This will help you understand you spending habits so that the lifestyle that is important to you will be maintainable as a homeowner.