How to Buy Your Dream Home When You Have Student Debt

Many people new to the workforce are strapped with student loan debt. Some are eager to purchase a home but believe that they cannot because they have not saved for a down payment or they will not qualify because of the debt.

Fortunately, there are loans and programs that are designed to help. Below are a few ways that people in this situation can buy a home.

1. Deferring student loans or getting an income-based repayment plan. Student loans are not designed to hamstring people to the point that they cannot afford to own a home. There are several programs available that allow student loan debt to be temporarily deferred or lower the monthly payment based on income.

1. Deferring student loans or getting an income-based repayment plan. Student loans are not designed to hamstring people to the point that they cannot afford to own a home. There are several programs available that allow student loan debt to be temporarily deferred or lower the monthly payment based on income.

Here is a resource for helping you navigate each of these. Note that different loan types treat deferred student loans and income-based repayment differently. You will need to go over these guidelines with your mortgage professional.

2. Co-signers. Some loan types will assign 1 percent of the balance of student loans to the debt to income ratio even if the loans are deferred or they are income-based repayment. For these folks, a viable alternative is a co-signer. Fortunately, most loan types will allow for family members to cosign. Again, it is something a good lender will advise and consult you on.

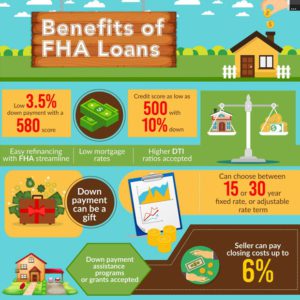

3. Gifts or low-down loans. Some have been unable to save enough money for a down payment. There are alternatives to this as well. Some loans like the USDA and VA loans do not require a down payment. Other loans, like the MSHDA loan, allow for 1 percent and loans through Fannie Mae or FHA allow folks to come in with 3 percent or 3.5 percent. Your loan officer will know all of the options available to you.

4. Budgeting. Oftentimes a simple budgeting plan can save the day. At Michigan Mortgage, we review all household income and debts with clients to make sure that they can afford a home and still make all of their monthly payments, including student loan debt. In fact, we will help them create a budget if they don’t have one so that they are comfortable with their bill and the payment of a new home.

While student loans can seem daunting and stifling, they should not stop folks from pursuing the dream of home ownership. If you are ready to make homeownership a reality, contact us today for a consultation.

By collecting a fraction of those annual costs each month, the escrow account reduces the risk that you’ll fall behind on your obligations to the government or your insurance provider each year.

By collecting a fraction of those annual costs each month, the escrow account reduces the risk that you’ll fall behind on your obligations to the government or your insurance provider each year.

Tip #3:

Tip #3:

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

1. Plan ahead. Before you begin saving for a down payment for a home, you first need to know approximately how much you will have to save. Plan to sit down with a mortgage lender who will let you know what you qualify for.

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

“Before applying for a mortgage, clients really need to understand the importance of having established credit and having a good credit score,” said Jill Dobb, loan officer assistant at Michigan Mortgage. “Buying a home requires you to have credit and the better the credit score the better the interest rate you will qualify for.”

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.