What is an appraisal and why do you need one?

One of the most confusing aspects of obtaining a home can be the appraisal process.

Most people think when you buy a house that the selling price is the value of the home. The truth is, the value of the home is primarily based on other properties that have already SOLD in the same market area.

A real estate appraisal is the process of assigning an objective value for a home.

A real estate appraisal is the process of assigning an objective value for a home.

The buyer is free to pay whatever they like for the home. If the buyer intends on getting a mortgage, then they are required to get some type of home appraisal. The opinion of value (the appraisal) is based on properties (comparable properties) that have sold in the past.

Why Is a Real Estate Appraisal Needed?

Appraisals are an important part of the home buying process. A real estate appraisal establishes a property’s market value—the likely sales price it would bring if offered in an open and competitive real estate market. Lenders require appraisals when buyers use their new homes as security for their mortgages.

What Is Comparable Property?

It is properties with characteristics that are similar to a subject property. The appraiser is looking for similar square footage, floor plan, the number of rooms, type of rooms and location to name a few. The best comparable could be the home next door or a few miles away. The best Comparable would be the house next door with the same floor plan, upgrades, view, everything exactly the same as the subject property that closed the day before the appraisal assignment.

When the home next door is not available the appraiser will attempt to find homes as close as possible and make adjustments. The adjustments are added or subtracted from the comparable property in an attempt to equal the subject being appraised. If one comparable did not have a 2 car garage like the subject. The appraiser would add the approximate value of the garage to the comparable to bring it up to the subject. If the comparable had a 3 car garage the appraiser would subtract from the subject the value of the extra garage.

Who Does the Appraisal?

Appraisals must be conducted by a licensed, third-party appraiser who has no connection to the buyer, seller or lender. That way, all parties can be sure the determined market value is fair, unbiased and free of any influence from any party that could benefit.

The lender usually orders the appraisal, but the borrower is the one who usually pays for it. The appraisal fee is an upfront, out-of-pocket expense that will not be refunded if either party fails to move forward with the sale.

What Does the Appraiser Look For?

Appraisers look inside and outside your house. They look at the neighborhood, too.

Externally, here’s what they look for:

- Neighborhood characteristics (i.e., urban, suburban, rural)

- Percentage of present land use in the neighborhood (one-unit housing, two- to four-unit housing, multifamily, commercial)

- Zoning classification

- Lot size

- Whether the property has public utilities

- The type of driveway surface and any car storage.

Internally, they look at things like:

- The home’s square footage

- Number of bathrooms and bedrooms

- Remodeled versus updated kitchen/baths

- Foundation type

- Whether there’s a full or partial basement, crawl space, or attic

- Materials used for the walls, floors, and windows

Get Preapproved First

An appraisal is one of the final steps of buying a home. Your first step should be to contact a lender near you to get the process started.

This blog post was written by experts at Mortgage 1 and originally appeared on www.mortgageone.com. Michigan Mortgage is a DBA of Mortgage 1.

Here are a few of our favorite highlights. If you’d like to learn more about 2020 community involvement,

Here are a few of our favorite highlights. If you’d like to learn more about 2020 community involvement,

#2: Know what you can afford

#2: Know what you can afford

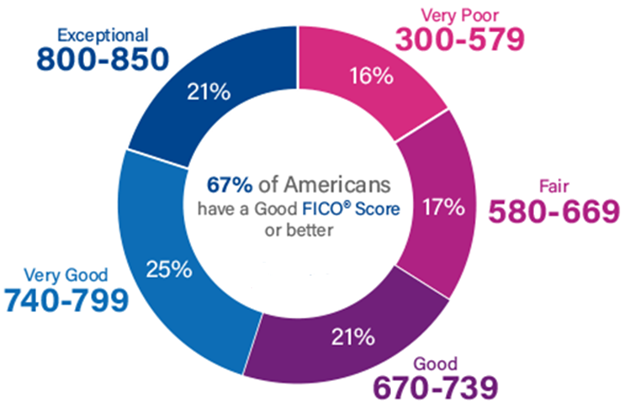

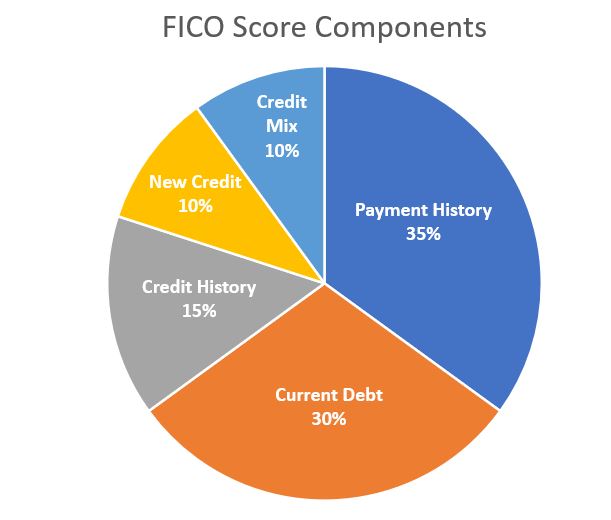

Most people assume that their Credit Karma score is their universal credit score when applying for a home or auto loan. When their true mortgage credit score is pulled by their Loan Officer, shock and anger typically follow. Why are they different? Did the Loan Officer pull the wrong score?

Most people assume that their Credit Karma score is their universal credit score when applying for a home or auto loan. When their true mortgage credit score is pulled by their Loan Officer, shock and anger typically follow. Why are they different? Did the Loan Officer pull the wrong score?

However, such conveniences have not always existed for us. I’ve been working for Rob and Dave for 19 years. When I started, our office was downtown Muskegon in the Noble Building. The tech set up we had there was already a vast improvement from the first few years Rob and Dave worked together, at which time they each had a home phone, a computer, and a fax machine in their basement home offices.

However, such conveniences have not always existed for us. I’ve been working for Rob and Dave for 19 years. When I started, our office was downtown Muskegon in the Noble Building. The tech set up we had there was already a vast improvement from the first few years Rob and Dave worked together, at which time they each had a home phone, a computer, and a fax machine in their basement home offices.

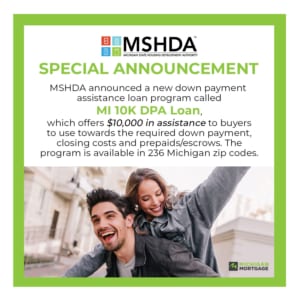

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

According to MSHDA, “This program was created to offer assistance to purchasers within specific geographic areas where the opportunity to purchase a home is high but the rate of homeownership needs improvement. Homebuyers looking to purchase a home within one of these areas will benefit from additional support to help them achieve homeownership.”

Abbi McIntyre

Abbi McIntyre Rose Engel

Rose Engel Jason Horton

Jason Horton David Onofrio

David Onofrio Rose Orleskie

Rose Orleskie Hannah Moss

Hannah Moss

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.

#1. On average, buyers spend 10 weeks searching for a home and view an average of 10 houses.