When is the right time to lock in your interest rate?

Interest rates can be tricky. They change often, rising and falling with the market.

We want to make sure you’re getting the best rate possible, and we do that by locking your rate. How and when do we lock? Not all lenders are created equal, as you will see, but we wanted to take some time to explain our thoughts on the issue.

How do we know when to lock?

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

As interest rates continue to rise and the market becomes more volatile, it is more important than ever that your interest rate is locked at the right time. So, when is the right time to lock? This article will discuss what goes into deciding when, and under what circumstances your loan should be locked.

There are two timing questions that should be considered.

- How far in advance of closing should you lock?

- How do you know if the market is getting better or worse?

How far in advance of closing should you lock?

What many people don’t know is that a shorter lock duration generally gives you better pricing than a longer lock duration. I am not talking about the term (30-year loan v. 15-year loan) but rather the number of days the locked rate is secured before the closing happens. In other words, at any given time of day, if you lock for 15 days it is better pricing then if you lock for 30 days. This is the case regardless of the term of the loan.

One might deduce that it makes more sense to wait as long as you can (just before you close) to lock your rate. That might be a good strategy in a stable market, but not when rates are getting worse.

I think the old saying “pigs get fat and hogs get slaughtered” applies here.

I like to lock loans as soon as possible so long as you are willing and able to close within 30 days. Because the market is finicky, I would rather take what is available now rather than risk market shift and a higher rate. If the closing is farther out than 30 days, I usually wait a bit to lock unless there are some very strong indicators of increasing rates. This is because a longer than 30-day lock carries with it a higher rate regardless of what the market does.

Playing the Market

But How do you know if the market is getting better or worse? The short answer is… you don’t.

After 22 years in the business, I still rely heavily on experts to tell us where the mortgage market is going. We actually subscribe to a service that alerts us to lock our clients’ rates when the market is getting worse and to float when there is evidence it will get better or remain neutral. This is invaluable in a market like we currently have.

For example, in the last few weeks rates have increased four times. Each time before those rates moved, I was able to lock any loans that where floating and where scheduled to close in the next 30 days. Some of them I was able to lock on 15-day lock, thereby saving my clients thousands of dollars.

One last thought.

Clients that use lenders that cannot close within 30 days are at a significant disadvantage. Those that cannot close within 45 are even more vulnerable to a changing market. It is more important than ever to have a lender that can close quickly, watches rates and utilizes all technology available to them to make sure the client gets that best the market has to offer.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

We’re happy to introduce the program because, unlike the current MSHDA down payment assistance program, it’s a forgivable loan. In five years, if the borrower still occupies the home as their primary residence, the loan is completely forgiven. The loan is forgiven 20 percent each year until the five-year mark is reached.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

Here’s what Eric Ridlington, owner of Prestige Appraisal Service, had to say about the process.

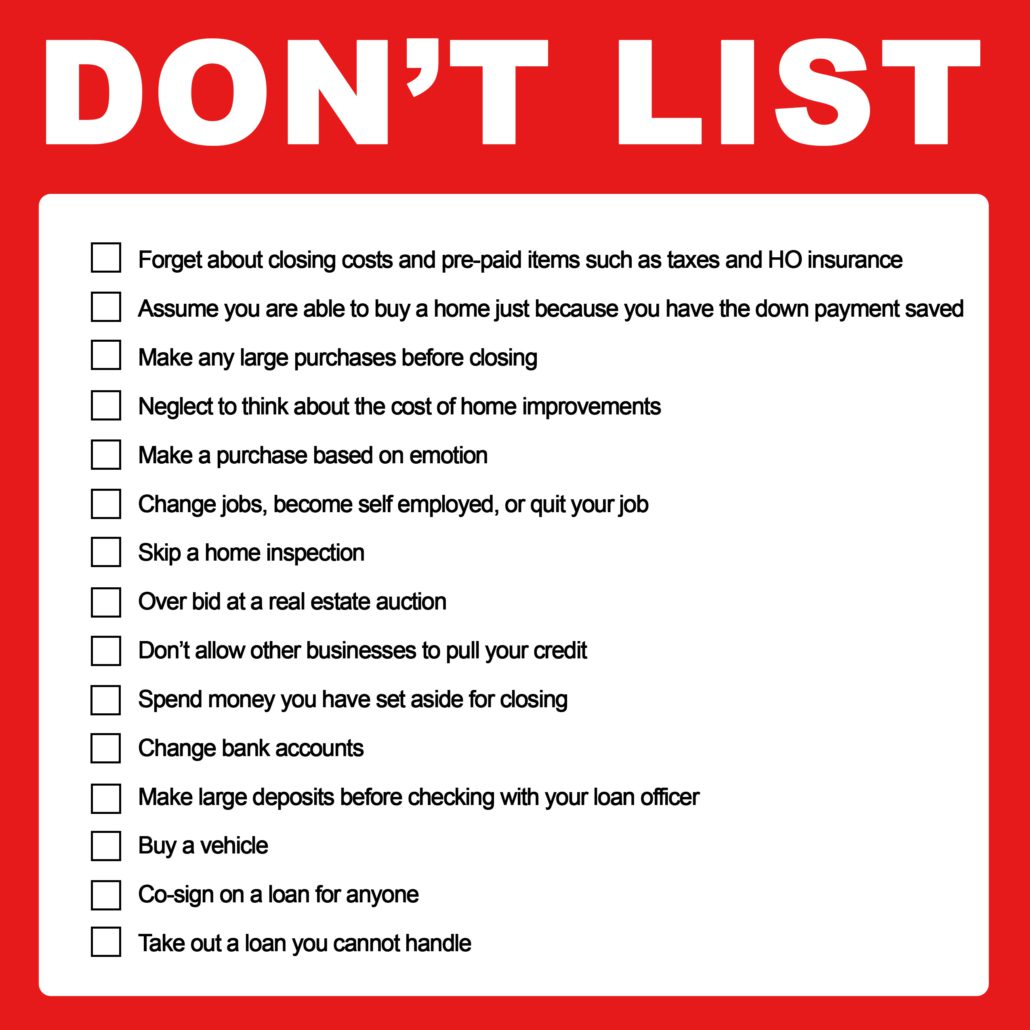

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

In what is called “a seller’s market” multiple offers are being made days and sometimes hours after a property is listed on the market. We have seen purchase agreements that are tens of thousands of dollars more than list price.

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

Ryan Hendrickson: I would recommend getting a quote as soon as an offer has been accepted. When purchasing a home, especially in this seller’s climate, a speedy close is often a requirement of the offer. If you’re able to finalize your homeowners insurance early in the process, you will insure that it will not cause any unnecessary delays in your loan closing.

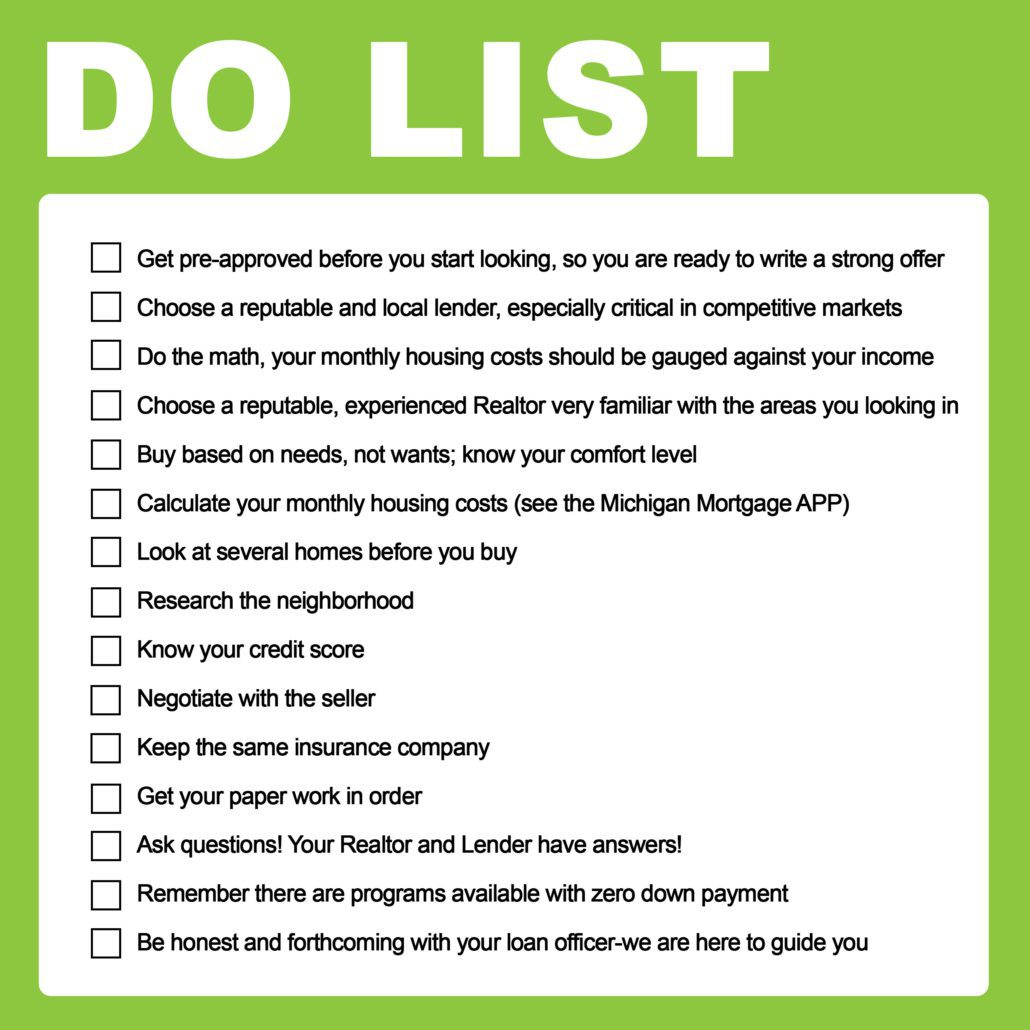

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.

Without a mortgage from a reputable and trusted lender, you may not get a house in today’s market. While shopping with a reputable realtor is important, make sure you allot the time and attention to your home loan first.