FICO Score: What It Is & Why It Matters

When you apply for a mortgage, your lender runs a credit report. A key component of the report is your credit score. One of the most commonly used credit scores in the mortgage industry is FICO.

In this article, we describe what FICO is, how it is measured, how it is used when approving you for a mortgage, and steps you can take to maintain and improve your credit score.

What is FICO?

FICO is a credit score created by the Fair Isaac Corporation (FICO). The FICO company specializes in what is known as “predictive analytics,” which means they take information and analyze it to predict what might happen in the future.

In the case of your FICO score, the company looks at your past and current credit usage and assigns a score that predicts how likely you are to pay your bills. Mortgage lenders use the FICO score, along with other details on your credit report, to assess how risky it is to loan you tens or hundreds of thousands of dollars, as well as what interest rate you should pay.

Why is FICO Important?

FICO scores are used in more than 90% of the credit decisions made in the U.S. Having a low FICO score is a deal-breaker with many lenders. There are many different types of credit scores. FICO is the most commonly used score in the mortgage industry.

A lesser-known fact about FICO scores is that some people don’t have them at all. To generate a credit score, a consumer must have a certain amount of available information. To have a FICO score, borrowers should have at least one account that has been open for six or more months and at least one account that has been reported to the credit reporting agencies over the last six months.

FICO Score Ranges

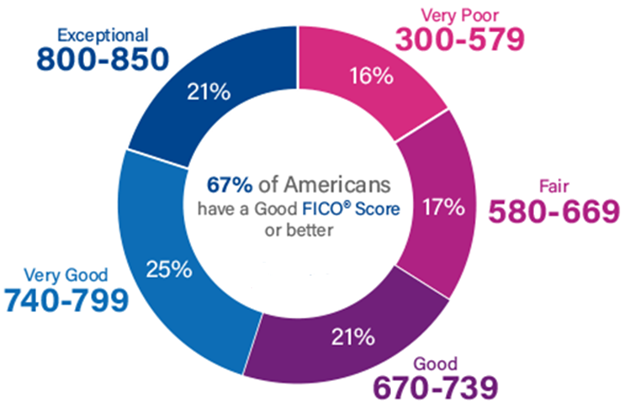

FICO scores range between 300 and 850. A higher number is better. It means you are less risk to a lender.

Scores in the 670-739 range indicate “good” credit history and most lenders will consider this score favorable. Borrowers in the 580-669 range may find it difficult to obtain financing at attractive rates. Less than 580 and it is difficult to get a loan or you may be charged “loan shark” rates.

The best FICO score a consumer can have is 850. Fewer than 1% of consumers have a perfect score. More than two-thirds of consumers have scores that are good or better.

Here’s a breakdown of scoring ranges and what they mean:

- Score: <580

Rating: Poor

What It Means: Well below average; Indicates to lenders that you’re a risky borrower - Score: 580-669

Rating: Fair

What It Means: Below average; many lenders will approve loans, but many will not - Score: 670-739

Rating: Good

What It Means: Average or slightly above average; most lenders will approve loans - Score: 740-799

Rating: Very Good

What It Means: Above average; shows lenders you are a dependable borrower; nearly all lenders will approve you - Score: 800+

Rating: Exceptional

What It Means: Well above average; shows lenders you are an exceptional borrower; virtually every lender will approve you

Source: Experian

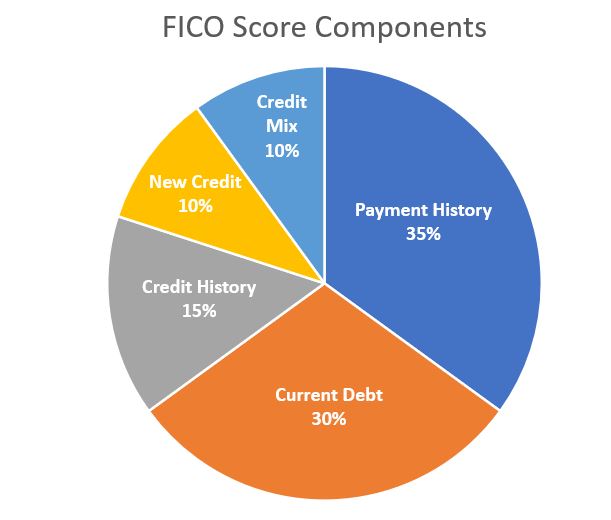

The 5 Components of a FICO Score

A FICO score take into account five areas to determine the creditworthiness of a borrower:

- Payment History. Payment history identifies whether you pay your credit accounts on time. A credit reports shows when payments were submitted and if any were late. The report identifies late or missing payments, as well as any bankruptcies.

- Current Indebtedness. This refers to the amount of money you currently owe. Having a lot of debt does not necessarily mean you will have a low credit score. FICO looks at the ratio of money owed to the amount of credit available. For example, if you owe $50,000 but are not close to reaching your overall credit limit, your score can be higher than someone who owes $10,000 but has their lines of credit fully extended.

- Length of Credit History. The longer you have had credit, the better your score will be. FICO scores take into account how long the oldest account has been open, the age of the newest account, and the overall average.

- Credit Mix. Credit mix identifies your variety of credit accounts — retail accounts, credit cards, installment loans, vehicle loans, mortgages, etc. More variety gives a higher score.

- New Credit. New credit refers to recently opened accounts. If you have opened a lot of new accounts in a short period of time, that will lower your score.

How is FICO Calculated?

To determine credit scores, FICO weighs each category differently:

- Payment history is 35% of the score

- Current indebtedness is 30%

- Length of credit history is 15%

- Credit mix is10%

- New credit is 10%

- Participation in a credit counseling program

- Employment information, including your salary, occupation, title, employer, date employed or employment history

- Where you live

- The interest rates on your credit accounts

- “Soft” inquiries (requests for your credit report), which include requests you make to see your own credit reports or scores

- Any information that has not been proven to be predictive of future credit performance

Tips for Improving Your FICO Score

Here are tips for maintaining and improving your FICO score. The time it takes to improve your credit score depends on the reason your score needs boosting in the first place. If your score is low because you don’t have much credit history, your score can be boosted within months. If your score is low for other reasons, boosting it can take longer.

- Keep Credit Balances Below Limits. Getting a high FICO score requires having a mix of credit accounts and maintaining an excellent payment history. You should keep your credit card balances well below their limits. Maxing out credit cards, paying late, and applying for new credit all the time will lower FICO scores.

- Dispute Errors. It’s possible to improve your credit score in a matter of weeks. For example, you could successfully dispute errors on your credit report, pay down credit card debt, or pay off collections accounts. These actions could remove negative information from your credit report or add some positive info, either of which may benefit your credit score.

- Pay Bills On Time. Realistically, here’s what you need to do: pay your monthly bills on time. A single on-time payment won’t do much to improve your score. Paying your bills regularly on-time will.

Here’s how different actions can negatively affect your credit score and for how long:

| Action | Avg. Recovery Time | Credit Score Impact |

| Applying for Credit | 3 months | Minor |

| Closing an Account | 3 months | Minor |

| Maxing Out a Credit Card | 3 months | Moderate |

| Missed Payment / Default | 18 months | Significant |

| Bankruptcy | 6+ years | Significant |

Have questions about FICO or anything else mortgage-related? Give us a call!

This blog post was written by experts at Mortgage 1 and originally appeared on www.mortgageone.com. Michigan Mortgage is a DBA of Mortgage 1.

Leave a Reply

Want to join the discussion?Feel free to contribute!