Five Tips to Improve Your Credit Score

Your three-digit credit score can make or break your financial future.

Interested in buying a home? Your credit score will determine whether or not you qualify. Looking to buy a new car or recreational vehicle? Your credit score will determine your interest rate. Hoping to take out a personal loan to invest in your child’s future? You need to have good credit to do so.

If your credit score isn’t up to par, we’re here to help! But before we offer you tips to improve your three-digit score, we want to make sure you understand how your score is calculated.

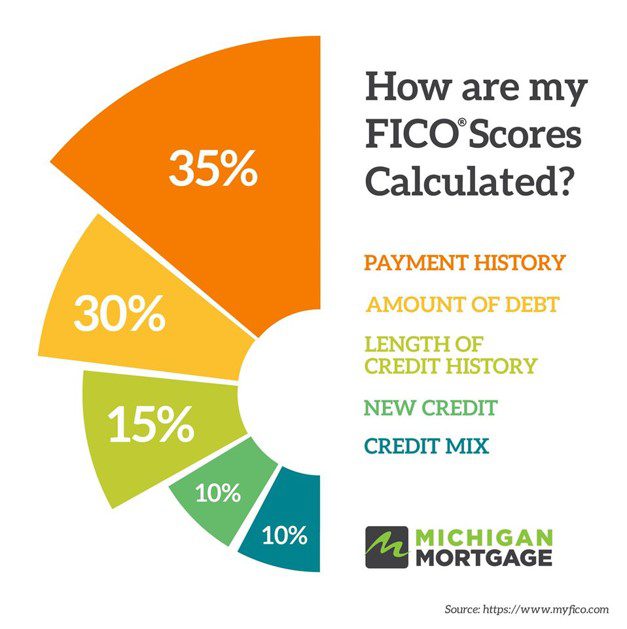

A combination of five factors determines your FICO credit score; some factors impact the score more than others. Take a look at the graph below to better understand.

FICO scores can range from 300 to 850, but for mortgage purposes, your goal should be 680 or above.

Here are five tips to help you reach that 680 benchmark.

- Make sure your credit reports are accurate. Lenders analyze reports from three credit bureaus when you apply for a mortgage – Equifax, TransUnion and Experian. If you don’t have a copy of your reports, you can claim a free report from each bureau once every 12 months at annualcreditreport.com. Mistakes are known to happen, and reporting errors can have a negative impact on your score. If you find a credit reporting error, dispute the mistakes with the appropriate credit reporting agency and your score may improve.

- Make your payments on time. According to experts, a large portion of your credit score (35 percent, to be exact) is calculated based on payment history. Making your payments on time, every time can greatly impact your score. This includes credit card bills or any loans you may have, such as auto loans or student loans, your rent, utilities, phone bill and so on.

- Reduce the amount you owe. Roughly 30 percent of your credit score is calculated based on the amount of debt you owe. Most loan programs have very specific debt-to-income ratios in place that can keep you from purchasing your dream home. For the ultimate credit score boost, credit experts suggest you pay on time, twice per month, and decrease the amount you owe. This will help control the factors that collectively make up 65 percent of your score.

- Become an authorized user on someone else’s credit card account. This is easier said than done, but if your spouse or parent has excellent credit and a perfect payment history, it would benefit you (and improve your credit score) if you were added as an authorized user on their credit card account. Why? The account will show up on your credit report as well as the credit utilization rate and all the on-time payments associated with the account, which will naturally increase your score.

- Open a secure credit card. Opening a secure credit card, and using it properly, can help to increase your credit score. You’ll be required to deposit money into a checking account to secure the line of credit. Payments will come directly out of this account, so they will always be on time and will never be missed.

Your credit score won’t improve over night, but with a little hard work and dedication, you’ll be moving into your dream home in no time.

It’s good to know that you should start paying on time twice a month. My sister was telling me last night about how she is wanting to look into working with a credit repair service in a couple of weeks, and she wanted to know some additional tips that can help her credit score. I’ll make sure to pass these tips along to her once she finds a credit repair service that can help her.

Your article is very nice. You have provided interesting information. I will return to your site often to check. Keep up with your good work.